The Unlocking Value Bulletin #4

AI, Real Estate, and the Future: What You Need to Know Now

Welcome to a new issue of the Unlocking Real Estate Value newsletter. Each week I will provide you with exclusive advice and professional insights to help you realise long-term value through real estate development.

This week, I’ve pulled together real estate stories that stood out in my LinkedIn feed.

As you'll see below, there's been a lot of buzz about how AI is reshaping real estate. People are talking about how AI speeds up DCF model analysis, makes site selection smarter, and helps with better decision-making.

AI is moving fast, and new Deep Research tools are starting to show real power. Try it out if you haven’t yet — and message me if you want a quick intro.

Let’s dive in.

Latest Deep Dive

Latest Unlocking Value Bulletin

1. "What you read is what you think" is a pretty well-known cliché, but it seems incredibly true when it comes to the office market.

Maciej Markowski explores how narratives around the office market are often shaped by selective media headlines rather than actual data. The post highlights how cognitive biases and echo chambers can distort investor and occupier decisions — a reminder that perception often drives reality in CRE.

2. How 4 AI models suggest radically different futures for LosAngeles using identical open data.

Yair Titelboim shares a fascinating visualization showing how four different AI models generate wildly different predictions for Los Angeles — all from the same open data inputs. The post is a powerful illustration of AI’s subjectivity and the importance of model transparency in urban planning.

3. The commercial real estate industry is at an inflection point. AI is no longer just a back-office tool.

Eduardo Foss reflects on the shift in how AI is being used in commercial real estate. Once confined to ops and data tasks, it’s now starting to shape strategic decisions, influence acquisitions, and even challenge legacy decision-making frameworks in real time.

4. Vienna, a city repeatedly acknowledged as the most liveable city globally, showcases an intriguing approach to addressing the housing crisis.

This post spotlights Vienna’s innovative and long-standing approach to public housing — a model that combines affordability, high design standards, and community inclusion. It’s a refreshing alternative to profit-driven development and a playbook worth studying amid today’s housing crunch.

5. An interesting chart comparing REAL (ie adjusted for inflation) GDP per capita growth in OECD countries from Q1 2015 to Q3 2024

Jonathan Pearce shares a chart comparing real GDP per capita across OECD countries, showing how different economies have performed over nearly a decade. The post invites reflection on which nations have truly delivered rising living standards — and what that says about policy choices.

6. 2025: Here's what actually happened to PropTech sales:

This post unpacks what actually happened with PropTech sales after the hype cycle of 2021. It highlights the fall-off in landlord adoption, the rise of niche tools, and how some startups pivoted toward enterprise use cases to stay afloat.

7. The Navy Seals only use 3 questions to review missions.

Matt Schnuck shares a practical framework from the Navy SEALs: just three questions they ask after every mission. The post connects this elite military habit to business teams, encouraging fast, honest, and focused debriefs in CRE dealmaking and beyond.

8. If you lose 50% on an investment, it takes 9 years to breakeven at 8% interest

This post makes a powerful point: if you lose 50% on an investment, you need 9 years at 8% annual return just to break even. A sobering reminder that downside risk management is just as important as upside chasing — especially in real estate cycles.

9. After helping hundreds of founders raise capital for real estate ventures, here's the reality

Bharg reveals hard-earned lessons from helping hundreds of founders raise money for real estate ventures. Spoiler: it’s not just about the pitch deck. The post unpacks what really matters to investors and why many founders underestimate timeline, trust, and traction.

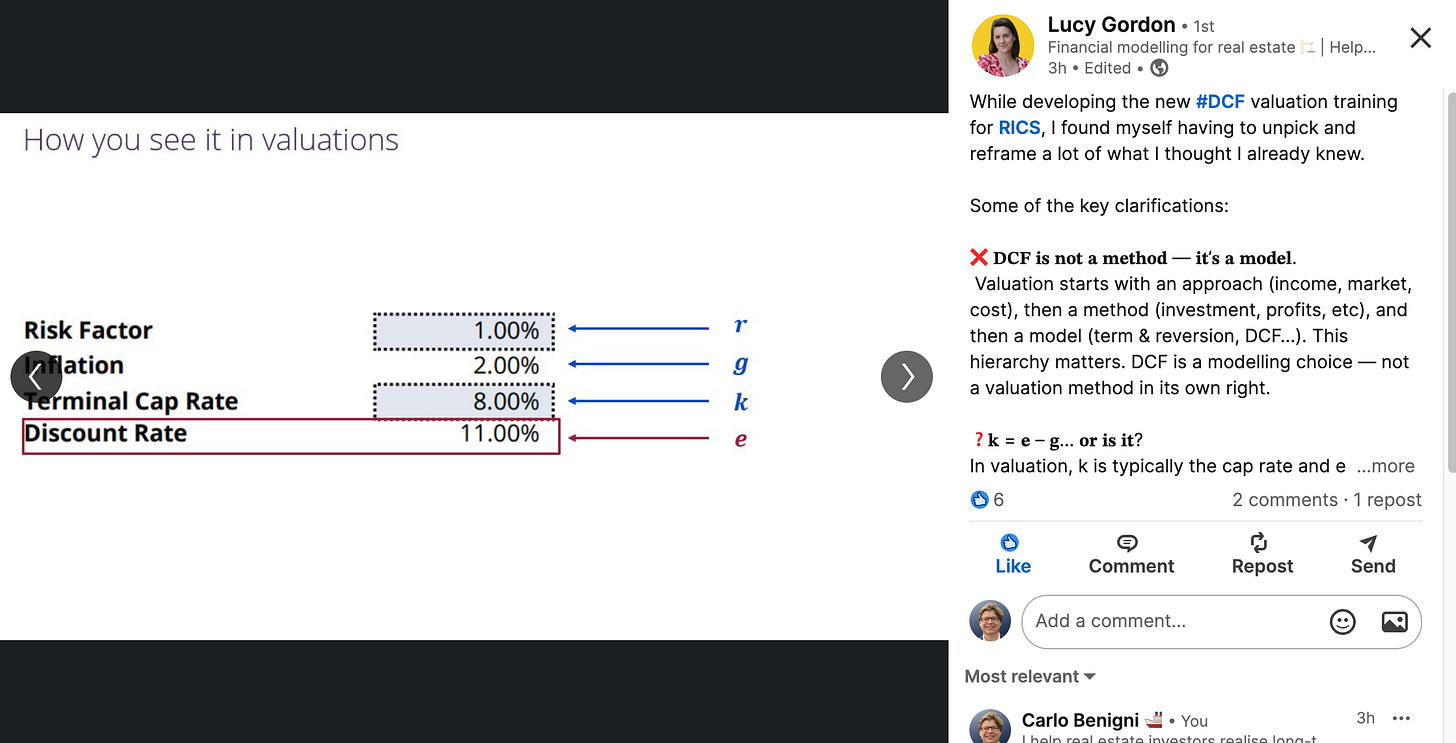

10. While developing the new DCF valuation training for RICS, I found myself having to unpick and reframe a lot of what I thought I already knew.

Lucy Gordon, while developing a new DCF training for RICS, realized much of her foundational thinking needed reworking. The post is a thoughtful reminder that even seasoned professionals benefit from revisiting the basics — especially in a fast-changing AI-driven valuation world.

That’s all for today.

See you next week.

— Carlo

Founder and Managing Director Benigni

And whenever you’re ready, there are 3 ways I can help you:

I’m now taking 5 calls per week.

Do you need help focusing the development strategy for a project?

I can help you brainstorm a development strategy or provide real estate market advice.

Tools and Resources to help you make smarter real estate investment decisions.

Refer a Colleague

PS…If you’re enjoying this newsletter, please consider referring this edition to a friend or a colleague. Sharing valuable insights helps everyone make better investment decisions.

This post is sponsored by Benigni a specialist development manager working with international investors to realise long-term value through optimised development strategies. To learn more click this link to our website.

Subscribe to the Newsletter

A newsletter by Carlo Benigni providing, in less than 4 minutes, exclusive advice, strategies, and resources to help unlock hidden real estate value.

Subscribe for free to receive new posts and support my work.

That Vienna story is interesting. There's a belief in the U.S. that a single-family home is best for raising children and our economy is built around that to some extent.