Why Italy’s Hotel Boom Isn’t Slowing Down: 3 Reasons Investors Still See Big Upside

Insights from the July 9 Hospitality Forum, Milan

Welcome to a new issue of the Unlocking Real Estate Value newsletter. Each week I will provide you with exclusive advice and professional insights to help you realise long-term value through real estate development.

Earlier this month I attended the annual Italy Hospitality Forum organised by Scenari Immobiliari in Milan. For the third year running the data about the market was extremely positive.

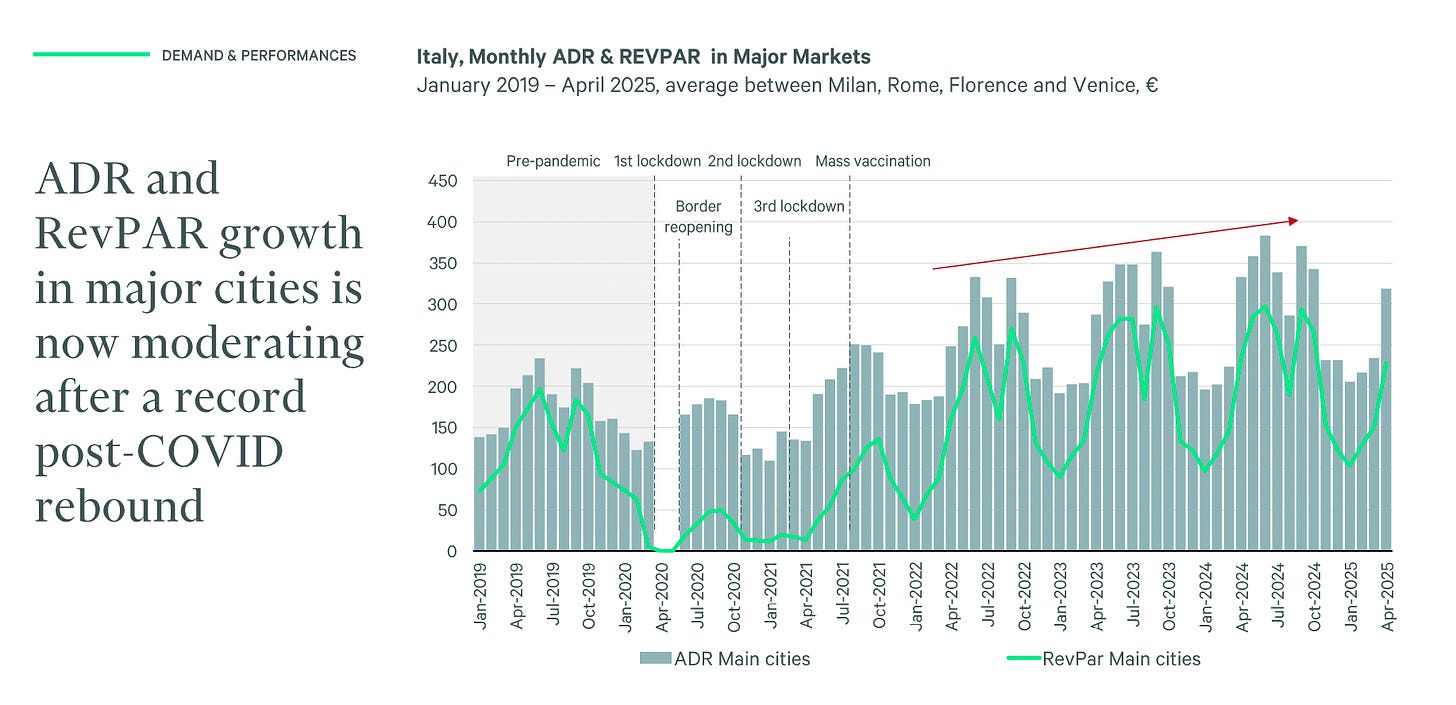

Italy clocked 466 million overnight stays in 2024, up 8 % on 2023. Occupancy reached 69% and the average daily rate hit €223, both record highs.

These gains aren’t a blip; they’re the new base.

Below are three reasons the experts say the upside is far from over—and how you can ride the wave.

Now let’s dive in.

1. Demand keeps beating forecasts across every segment

Big question. Will post-Covid travel fade after the “revenge” bump?

Misconception. Many expect a plateau as pent-up demand settles.

Core truth. Bookings are broad-based, deep, and sticky. Domestic stays rose 5% in 2024 while foreign visitor spending reached €54 billion. Rome now averages 82 % weekend occupancy and coastal resorts post 70% even in shoulder months.

OTAs showed search volumes for Italy running 18% above 2019. Airlines have launched 11 new long-haul routes this summer, slashing travel time from North America and the Gulf. Leisure travellers stay longer too: average trip length is 3.9 nights, up from 3.1 in 2019. Business events return with a twist: bleisure extensions add two nights per delegate.

The upside isn’t limited to gateway cities. Secondary art hubs like Bologna and Matera report double-digit RevPAR growth thanks to high-speed rail links and digital-nomad visas. Mountain and lake regions extend seasons by packaging spring wellness retreats and fall food festivals.

2. International capital is scaling up its Italian stake despite higher rates

Big question. Have rising debt costs chased money to safer bonds?

Misconception. Leverage-heavy deals no longer pencil out, so activity must crater.

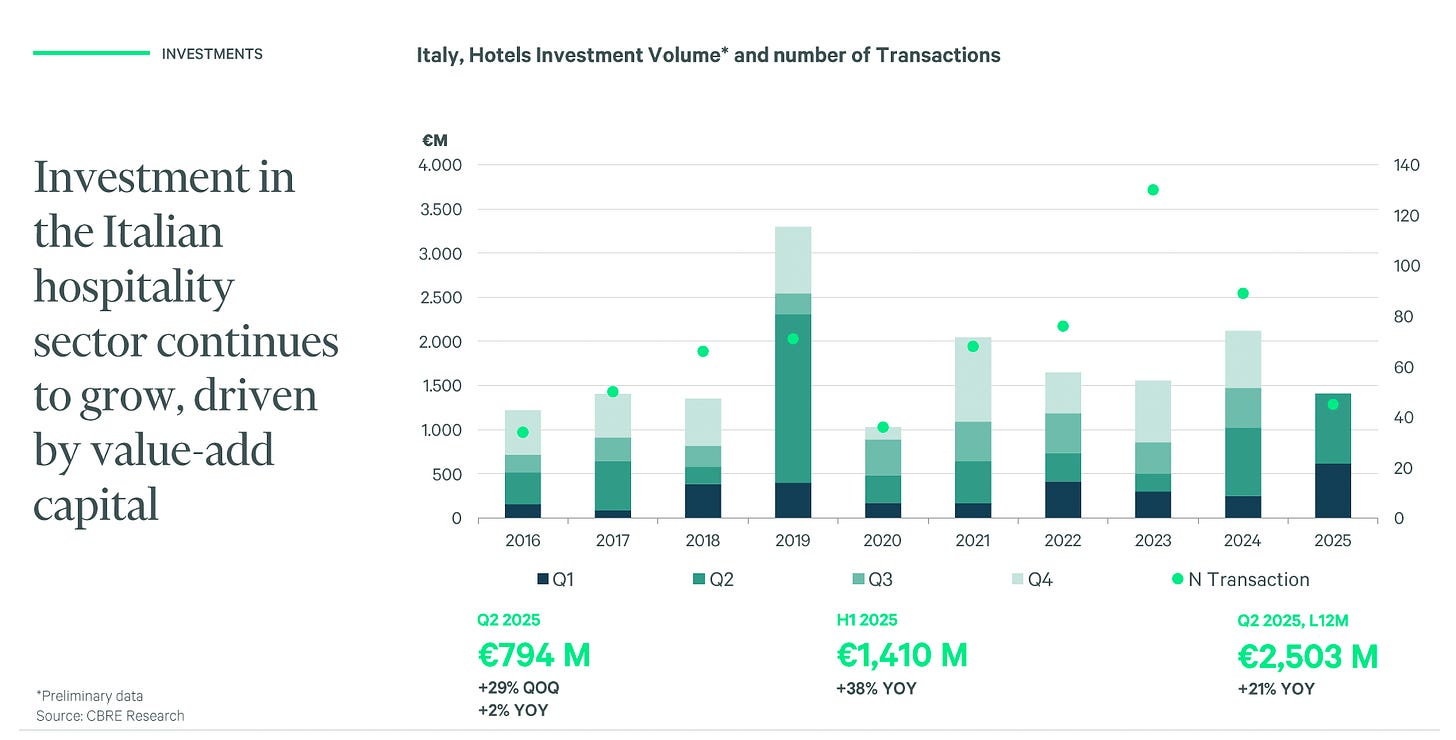

Core truth. Equity is driving most transactions, and investors still prize the sector. The Forum recorded €2.15 billion in hotel trades for 2024—53 % foreign-funded—and forecasts €2.7 billion for 2025.

Middle-Eastern sovereign funds led €1 billion of last year’s volume, including the €300 million Bauer Palazzo in Venice. U.S. private equity bought the JW Marriott Venice for ~€140 million and earmarked €60 million in upgrades. Canadian pension capital backed a €465 million redevelopment in Rome’s city core.

Italy’s own Fondo Nazionale Turismo doubled its portfolio to 20 assets, proving public-private muscle. Half of its €483 million commitments sit in southern regions—unlocking jobs, infrastructure and heritage refurbishments.

Strong exit evidence keeps IRR targets in range. The 2024 sale of a Milan four-star fetched a sub-5 % yield after a three-year value-add hold. Even mid-scale resorts can trade at 20× EBITDA once stabilised, beating office or retail returns.

3. New formats unlock higher-margin niches beyond classic hotels

Big question. Are glamping tents and treehouses investable or just Instagram bait?

Misconception. Alternative lodging is a tiny fad with little scale.

Core truth. These concepts scale profitably while widening Italy’s appeal. Glamping ADR sits at €90–200 with up to 85 % occupancy; treehouses reach €250 ADR on peak weekends. Tuscany already hosts 84 sites and floating hotels debut in Liguria this year.

Build costs run 30–40 % below concrete hotels, permitting is lighter and guests pay for the story, not just the bed. An eco-glamp outside Siena opened with 24 safari tents and hit 90 % occupancy in its first season, paying back equity in 3.5 years.

Beyond nature stays, alberghi diffusi revive hill-towns by turning vacant homes into branded keys. Local GDP can jump 10–15 % as cafes, craft shops and guide services bloom. Investors gain both revenue upside and ESG credibility, crucial for European institutional capital.

Summary & Takeaways

Demand is durable. Domestic and international travelers keep pushing occupancy and rates higher, with secondary cities and shoulder seasons adding fresh lift.

Capital is abundant. Cross-border equity and Italy’s own CDP fund remain eager to deploy, offsetting higher debt costs and accelerating asset upgrades.

Formats are diversifying fast. From glamping to alberghi diffusi, lower-cost models with premium pricing widen the opportunity set and deliver strong ESG stories.

That’s all for this week.

— Carlo

Founder and Managing Director Benigni

Related Articles:

More ways I can help you

And whenever you’re ready, there are 3 ways I can help you:

Do you need help focusing the development strategy for a project?

I can help you brainstorm a development strategy or provide real estate market advice:

Tools and Resources to help you make smarter real estate investment decisions:

Refer a Colleague

PS…If you’re enjoying this newsletter, please consider referring this edition to a friend or a colleague. Sharing valuable insights helps everyone make better investment decisions.

This post is sponsored by Benigni a specialist development manager working with international investors to realise long-term value through optimised development strategies. To learn more click this link to our website.

Subscribe to the Newsletter

A newsletter by Carlo Benigni providing, in less than 4 minutes, exclusive advice, strategies, and resources to help unlock hidden real estate value.

Subscribe for free to receive new posts and support my work.