Top 5 Booming Real Estate Sectors in Italy in 2024

Discover the Key Investment Opportunities Shaping Italy's Real Estate Market

Dear all,

A warm welcome to all new subscribers over the past week. Unlocking Real Estate Value is a weekly Newsletter providing exclusive advice and insights on how to optimise your development projects in 4 minutes.

Please remember to join in the discussion in my Substack Chat group accessible directly from the Substack App or Substack Website. The Chat it’s a space where you are all invited to discuss and ask me any questions about the topics of my newsletters.

Very Best,

Carlo

Unlocking Real Estate Value is a reader supported Newsletter.

If you enjoy what you read, please like, comment, share, and subscribe to help grow the community!

Today's newsletter gives an overview of the top real estate sectors attracting investors in 2024.

We will explore five key sectors shaping Italy's real estate market:

Industrial and Logistics.

Hospitality.

Data Centres.

Residential.

Purpose-Built Student Accommodation (PBSA).

These sectors offer unique growth prospects and challenges. We'll explain why they're important for investors wanting to benefit from Italy's changing market.

Now, let’s dive in.

1. Industrial and Logistics

This sector is growing because more modern storage and distribution centers are needed. E-commerce and third-party logistics (3PL) now use nearly half of all available space.

Rental rates have increased by about 9.3% each year over the past three years because there aren't enough suitable properties. Cities like Milan are hotspots for logistics investments, with many deals from portfolio transactions and value-add opportunities. But higher building costs mean fewer new developments, limiting supply. Still, sustainable and value-add assets are becoming popular as investors aim to meet ESG goals.

Investment Volume: In the first half of 2024, investments reached about €450 million, making up 15% of total real estate investments. Logistics properties are a main focus for big investors.

Transaction Data: Logistics investments greatly boosted real estate investment growth in early 2024.

Investor Takeaway: Now is a good time to find value-add opportunities and sustainable assets that could offer higher returns. Look for properties that meet ESG standards to reduce risks with financing and future rules.

2. Hospitality

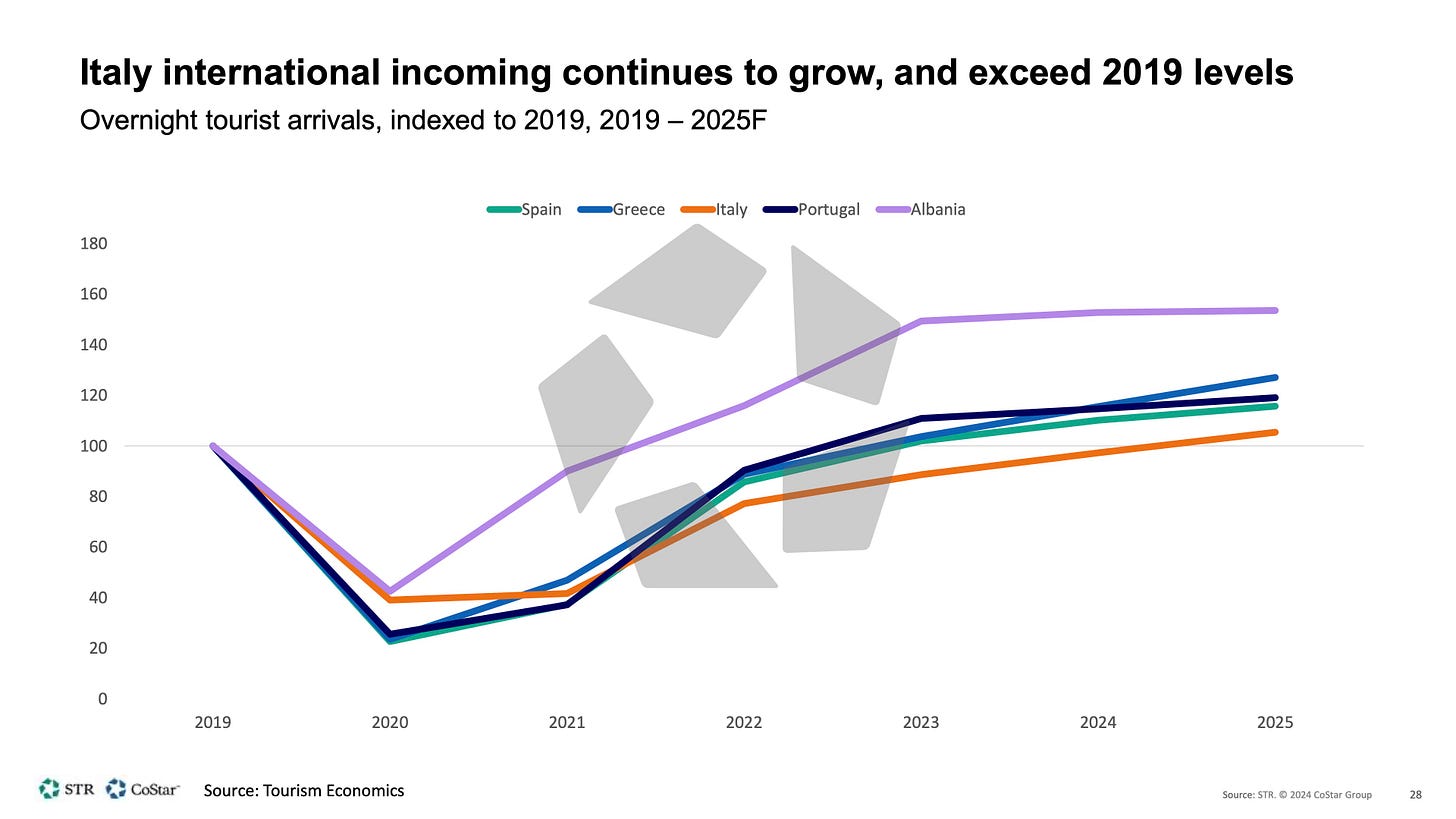

Italy's hospitality sector has bounced back strongly after Covid. A surge in international tourism and a booming luxury hotel market make Italy one of Europe's top destinations. This growth shows the strength of hospitality assets, even when the economy is uncertain.

Cities like Rome and Milan are performing well, with big increases in average daily rates (ADR) due to rising demand for luxury experiences. Rome's hotel market saw ADR increase by more than 10% compared to last year. Even though it's hard to finance lower-quality assets, top hotels still attract investors seeking long-term value.

Investment Volume: The hospitality sector made up 50% of all investments in Italy during the first half of 2024.

Transaction Data: Major deals included famous properties like the Palazzo del Monte in Milan and the Galleria Sciarra in Rome.

Investor Takeaway: Focus on luxury segments and culturally rich areas. Invest in properties that serve upscale travelers and prioritize regions popular with tourists.

3. Data Centres

As digital change speeds up, the demand for data centers in Italy is growing fast. Milan is becoming a key hub for data center development due to its strong connectivity and energy access. This sector is vital as it supports AI and cloud services needed in many industries.

In 2024, several big data center projects will start in Milan, focusing on sustainability. Advanced cooling technologies and energy-efficient designs are being used as operators aim for carbon neutrality by 2030. The growth of large cloud services is increasing demand for high-density data centers, making Milan a leading tech hub.

Investment Volume: The sector is growing due to increased demand for digital infrastructure and cloud services.

Market Dynamics: The move toward digitalisation and remote work keeps boosting interest in data center developments.

Investor Takeaway: Seek opportunities in sustainable data centers and edge locations. Edge computing can help solve issues like land scarcity and regulations. Invest in data centres that focus on energy efficiency and sustainability.

“Land for data centre development is scarce in Milan” - according to Colliers

4. Residential

Italy's residential market stays strong, with steady demand for prime properties in key cities like Rome and Milan. Limited housing supply and growing rental demand are pushing up property prices, making residential real estate a stable investment.

In 2023, top residential prices in Rome reached €14,450 per square meter, supported by strong rental demand from young professionals and students. Growth is boosted by city regeneration projects and infrastructure upgrades, enhancing certain neighborhoods. The residential market keeps attracting international buyers drawn to Italy's lifestyle, culture, and good long-term investment prospects.

Investment Volume: About 710,000 transactions are expected in 2024, showing a slight drop from previous years.

Transaction Data: Average prices are expected to rise modestly by about 2%. Luxury markets stay strong despite broader challenges.

Market Trends: The rental market is active, especially in cities where demand is higher than supply, causing rents to increase by about 5%.

Investor Takeaway: Focus on areas with urban regeneration or major infrastructure projects. Consider rental growth potential as demand from young professionals rises, especially in big cities.

5. Purpose-Built Student Accommodation (PBSA)

Purpose-Built Student Accommodation (PBSA) is seen as a promising asset class, driven by more students enrolling from Italy and abroad. Italy's current provision rate of 3.8% is below the European average, showing lots of room for growth.

Milan is a key city for PBSA investments, with rents rising because demand is higher than supply. The OECD projects that globally mobile students will reach 8 million by 2025, increasing demand for student housing. Recent deals highlight strong interest from big investors.

Investment Volume: The PBSA sector is seeing more investment due to ongoing student demand and a shortage of quality housing.

Market Dynamics: Italy's student accommodation rate is only 3.8%, much lower than in more developed markets.

Investor Takeaway: Focus on cities with many students and unmet housing needs. PBSA investments that serve international students and offer modern amenities could bring higher returns.

Conclusion

The trends in Italy's real estate market offer many opportunities for smart investments across different sectors. Whether it's logistics, hospitality, data centers, residential properties, or student accommodation, each area has unique benefits. Investors should focus on sustainability, urban development projects, and timing to navigate the changing landscape effectively.

Understanding what's driving growth in these sectors will help you make better decisions and take advantage of Italy's real estate potential. Each of the five sectors offers unique opportunities for stable, long-term returns. As you explore these investments, prioritize assets that meet ESG standards, adapt to new trends, and leverage Italy's cultural and economic strengths.

That’s all for now.

See you next week.

Other ways I can help you.

Do you need help focusing the development strategy for a project?

I can help you brainstorm a development strategy or provide real estate market advice.

Tools and Resources to help you make smarter real estate investment decisions.

Subscribe to the Newsletter

A newsletter by Carlo Benigni providing, in less than 4 minutes, exclusive advice, strategies, and resources to help unlock hidden real estate value.

Subscribe for free to receive new posts and support my work.