Stop Betting on Yesterday: 5 Lessons to Spot Real Estate Winners Before 2026

Next year will reward operators who act on trends: upgrade to prime, underwrite grid access, and convert weak stock.

Welcome to a new issue of the Unlocking Real Estate Value newsletter. Each week I will provide you with exclusive advice and professional insights to help you realise long-term value through real estate development.

As we approach the end of the year, today’s newsletter aims to provide you with an outlook on the main lessons I believe will shape real estate trends in 2026.

Every cycle has a “default bet.” For the past few years, that bet has been simple: the office is dead, AI is hype, and housing is “just” a social issue.

But the next 12 months will punish lazy takes. Some assets will stay liquid. Others will quietly become hard to finance, hard to lease and hard to exit.

Below are five lessons I’m using to spot winners next year:

Offices are finally coming back.

AI infrastructure investment will continue to grow.

GenAI adoption will reward Real Estate teams that redesign how they work.

Housing in the EU is a social infrastructure issue.

Adaptive Reuse of existing building stock is critical to make assets perform financially.

Let’s go.

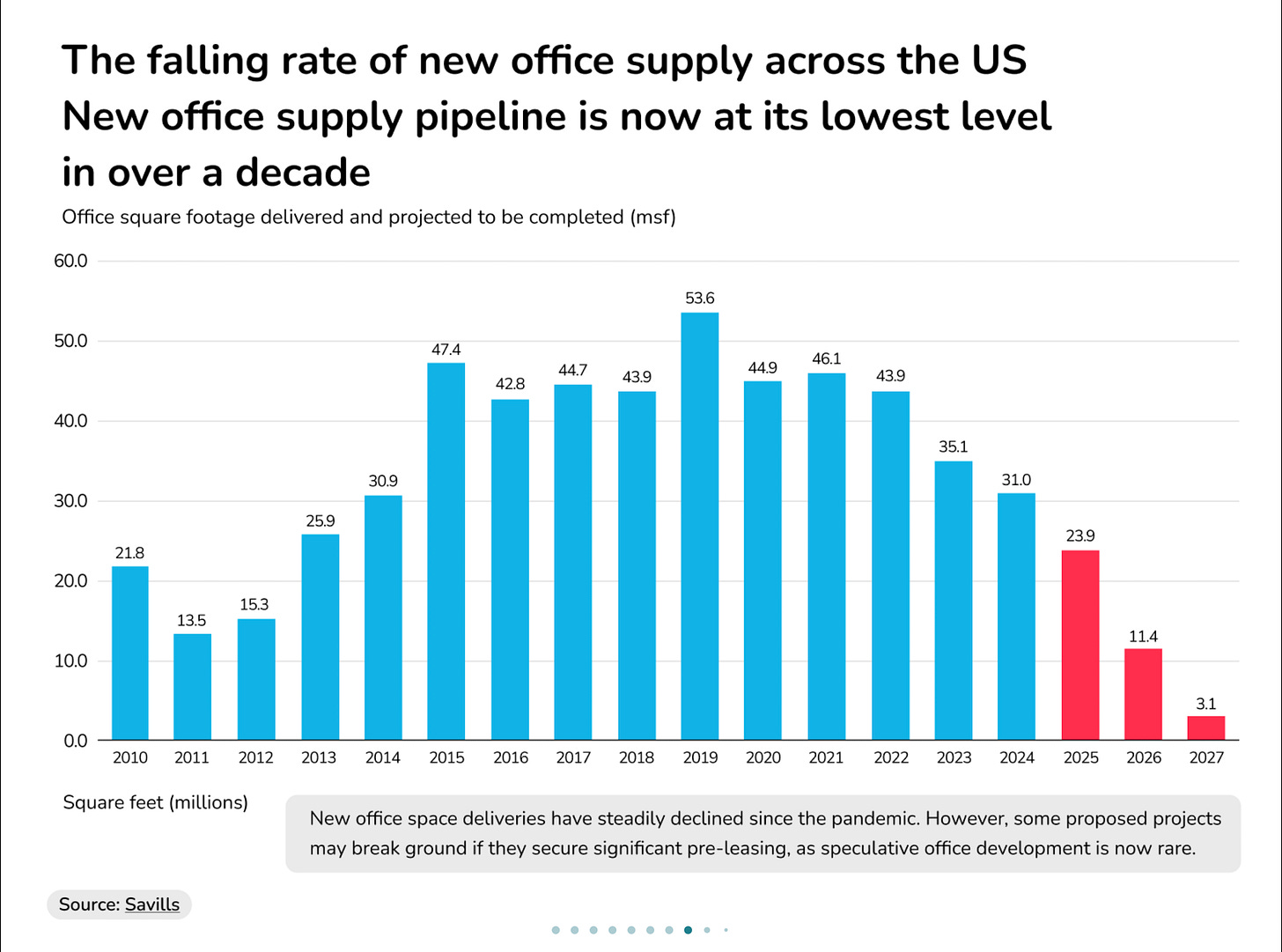

Lesson 1: Office investment is coming back, and “flight to quality” still stands.

The office story is not “back or gone.” It’s split. The “flight to quality” is still the main theme, but this is now also underpinned by an increasing shortage of available space.

Morgan Stanley has recently committed to stay in Canary Wharf HQ until 2038—a long bet on prime space. (Reuters)

New York shows the same pattern: return-to-office momentum is lifting deal hopes, mostly for top-quality offices, not the full market. (Reuters)

One practical shift: investors are focusing more on cash flow and downside protection, with cash-on-cash yields discussed in the 8%–15% range. (CBRE podcast)

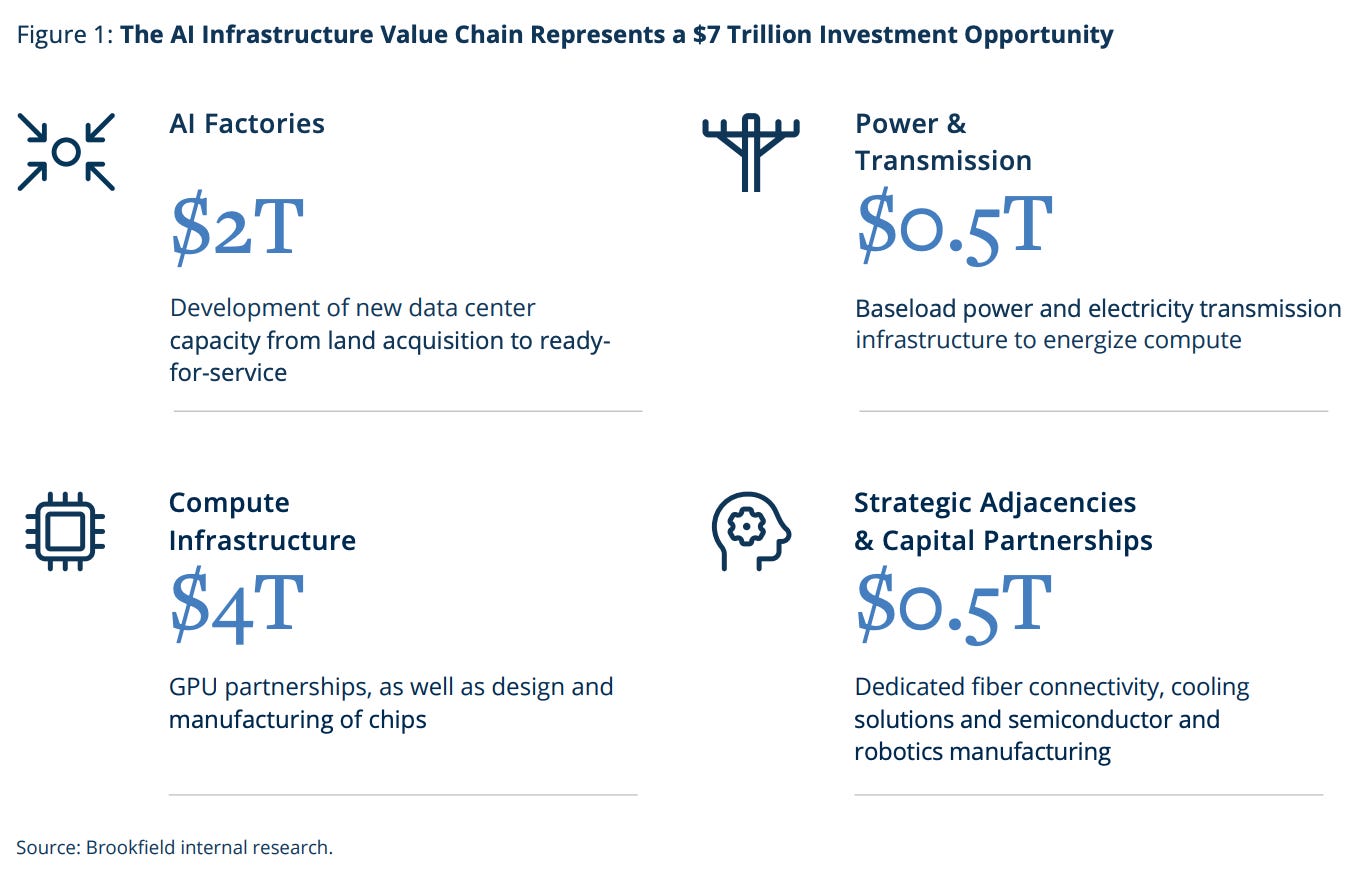

Lesson 2: AI infrastructure is a real estate story about energy, water, and speed.

If AI is the demand engine, power is the gate. This matters because right now the energy supply infrastructure is one of the main bottlenecks for data centre growth globally.

The IEA expects global data-centre electricity use to more than double by 2030, with AI a major driver. (IEA)

Brookfield’s $100bn AI infrastructure program is a signal that capital sees this as a long-run, real-asset buildout, not a short tech fad. (Brookfield)

And a helpful reminder: the value isn’t only the building shell. It’s what’s inside: compute, cooling, and uptime. (Weekly Take Podcast by CBRE)

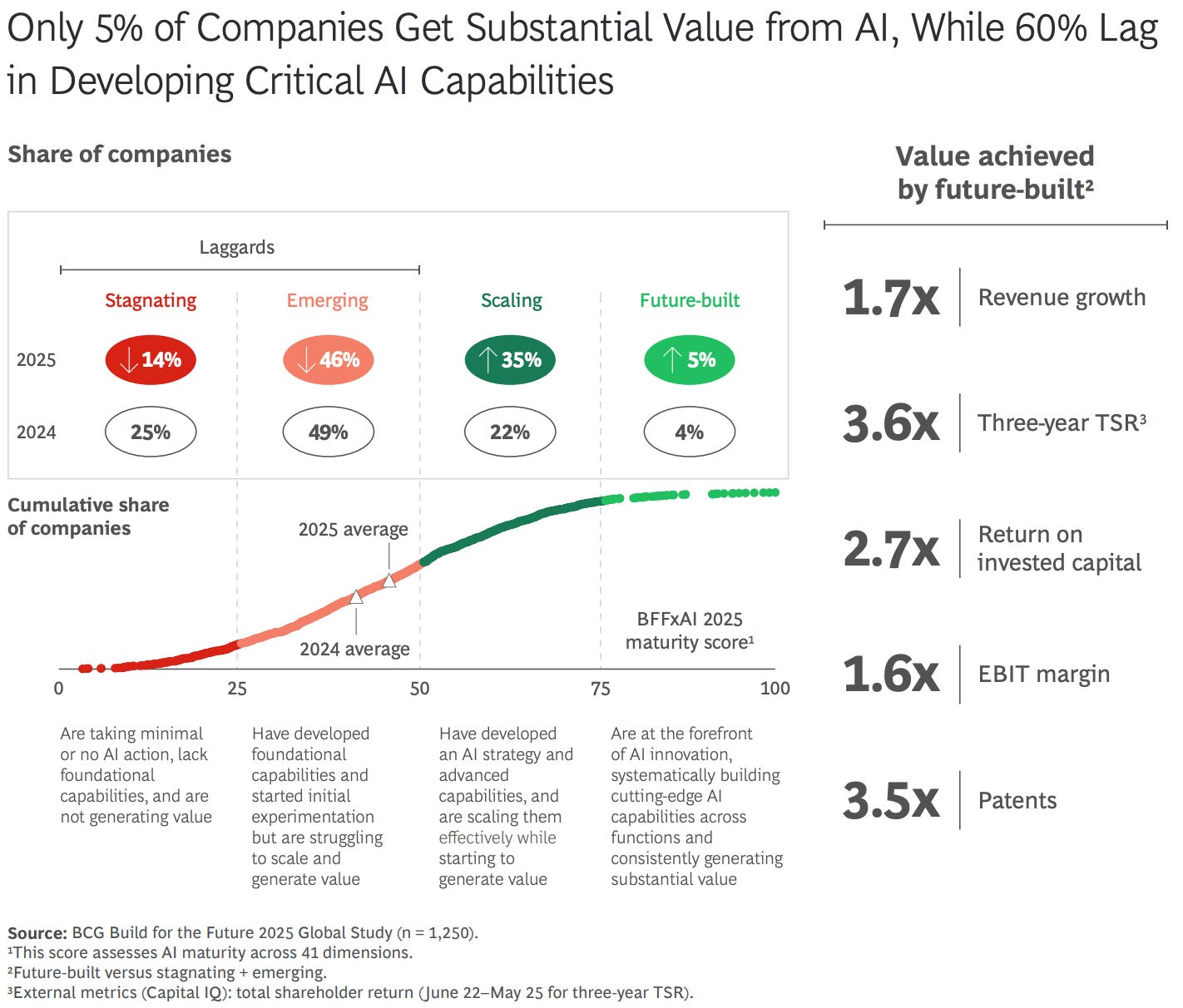

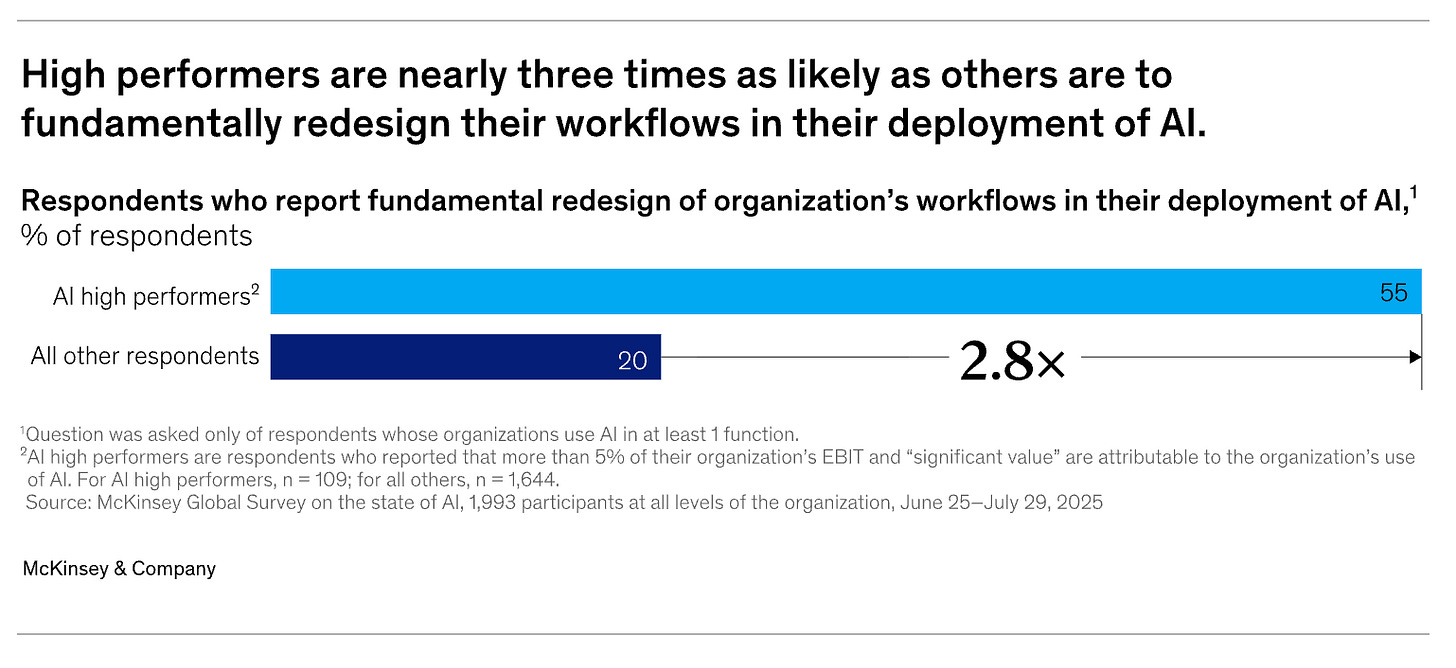

Lesson 3: GenAI adoption will reward teams that redesign work, not just buy tools.

Buying tools is easy. Changing work is hard. The data across the spectrum doesn’t lie; over 90% of companies say they have adopted AI, but only 5% report ROI gains. To AI Transformation experts and me, this is pointing to the fact that the workforce is not being appropriately EDUCATED.

BCG argues that the most significant gains come from redesigning workflows end-to-end, not from simply rolling out AI access. (BCG)

BCG also warns of a widening “AI value gap” between firms that build repeatable systems and those stuck in pilots. (BCG PDF)

McKinsey’s State of AI work points in the same direction: value shows up when AI is embedded in decisions and processes. (McKinsey)

Lesson 4: Housing is turning into social infrastructure.

Housing is moving from a sector issue to a competitiveness issue. The cost of housing is now a central theme for most developed economies in the Western world, this is impacting growth and social mobility.

The European Commission is pushing toward a Europe-wide Affordable Housing Plan, signalling housing as a strategic priority. (European Commission)

Public debate is also framing housing costs as a systemic risk for cities and social cohesion. (The Guardian)

And municipalities say they plan to increase investment in social infrastructure in the coming years, creating new pathways for public-private delivery. (EIB)

Lesson 5: Adaptive reuse is the bridge between empty space and real demand.

Reuse is no longer a “nice ESG story.” It’s a liquidity strategy. Repositioning assets that are no longer fit for their original use is critical to make them financially viable again. Working within the existing asset, these strategies can be achieved with reduced capex intensity.

In New York, office-to-housing conversions are at the highest rate since 2008. (Financial Times)

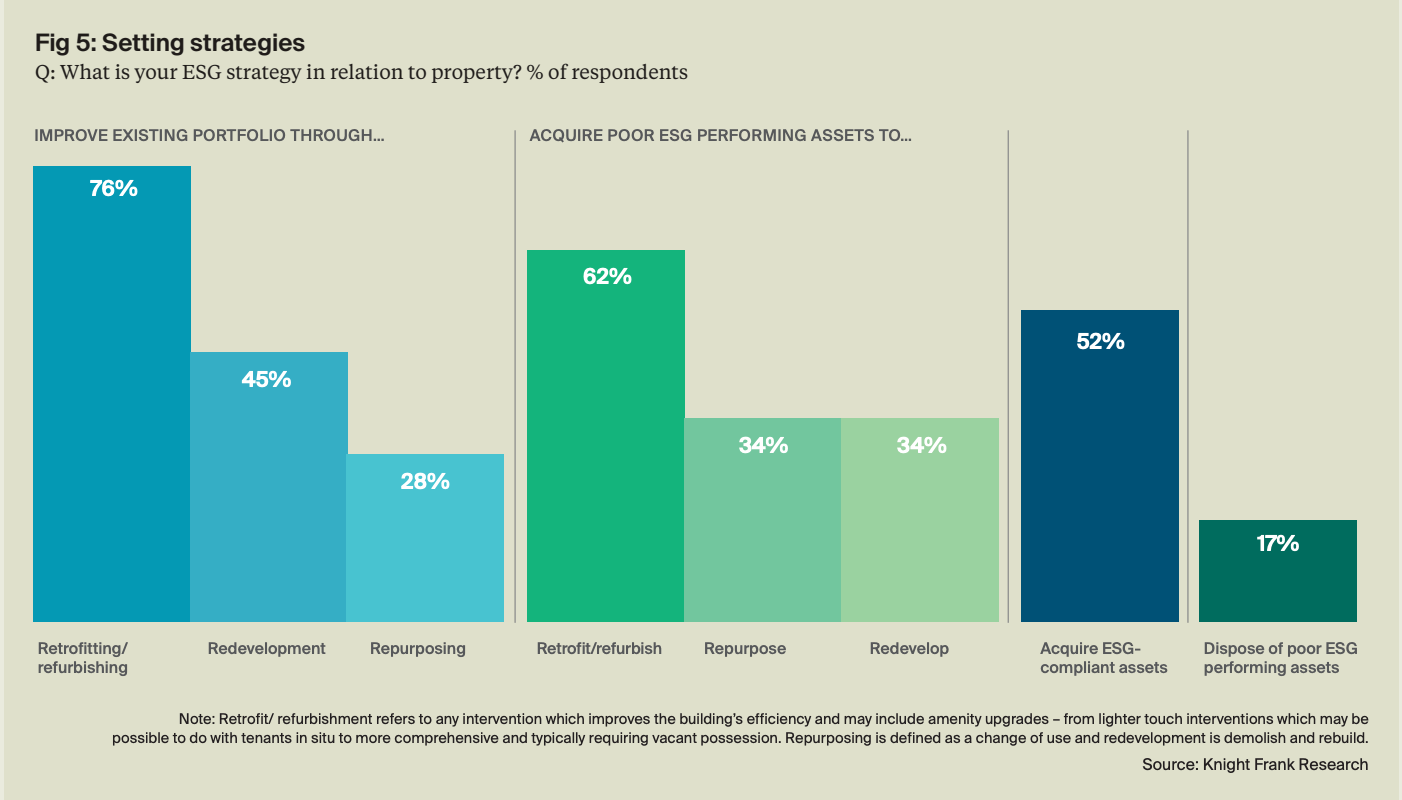

Knight Frank reports 76% of surveyed investors prioritise upgrading existing assets as their dominant ESG strategy. (Knight Frank)

In Europe, the updated EPBD direction tightens the logic: assets without a credible upgrade path risk becoming harder to finance over time. (European Commission)

Summary

2026 will reward investors who underwrite systems, not slogans: workplace systems, energy systems, delivery systems, and policy systems. The common thread across all five lessons is simple: quality and credibility win.

Re-rank office assets into “prime,” “fixable,” and “exit,” then fund the gap where it pays back. R1 R2 C1

Treat AI infrastructure like infrastructure underwriting: time-to-power, cooling, resilience, and delivery speed. I1 B1

Pick one repeatable GenAI workflow, redesign it end-to-end, and measure cycle time and error rate. G1 G2 M1

Frame housing as social infrastructure and build coalitions early with municipalities and mission capital. E1 H1 K1

Build a credible retrofit/reuse plan that keeps assets financeable as standards tighten. F1 N1 P1

Until next time,

Founder and Managing Director Benigni

Sources

R1 — Reuters: Morgan Stanley Canary Wharf lease to 2038 — ~2–3 min — https://www.reuters.com/business/morgan-stanley-commits-canary-wharf-home-until-least-2038-2024-04-03/

R2 — Reuters: New York return-to-office and deal hopes — ~4–6 min — https://www.reuters.com/markets/us/new-york-workers-return-office-ignites-deal-hopes-battered-real-estate-market-2025-03-07/

C1 — The Weekly Take from CBRE (Apple Podcasts) — 41 min audio —

I1 — IEA: AI driving data-centre electricity demand — ~6–8 min — https://www.iea.org/news/ai-is-set-to-drive-surging-electricity-demand-from-data-centres-while-offering-the-potential-to-transform-how-the-energy-sector-works

I2 — IEA: Energy and AI (Executive Summary) — ~10–15 min — https://www.iea.org/reports/energy-and-ai/executive-summary

B1 — Brookfield: $100bn AI infrastructure program — ~3–5 min — https://bam.brookfield.com/press-releases/brookfield-launches-100-billion-ai-infrastructure-program

Y1 — YouTube Music: Data centre value discussion — video length varies — https://music.youtube.com/watch?v=fxm40vYI8mU&si=StlEEcKW-wYbCGeF

G1 — BCG: Beyond AI adoption — ~4–6 min — https://www.bcg.com/press/26june2025-beyond-ai-adoption-full-potential

G2 — BCG: The Widening AI Value Gap (PDF) — PDF — https://media-publications.bcg.com/The-Widening-AI-Value-Gap-October-2025.pdf

M1 — McKinsey: The State of AI — ~10–15 min — https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

E1 — European Commission: Affordable housing action (Dec 16, 2025) — ~4 min — https://housing.ec.europa.eu/news/commission-takes-action-more-affordable-housing-across-europe-2025-12-16_en

H1 — The Guardian: Europe housing costs debate — ~6–8 min — https://www.theguardian.com/society/2025/dec/15/europe-housing-costs-new-pandemic-barcelona-mayor-eu-funding

E2 — European Commission: Housing document (PDF) — PDF — https://housing.ec.europa.eu/document/download/756915b5-d1b1-4bde-ac82-03532d2d3d90_en?filename=0.pdf

K1 — European Investment Bank: Municipalities survey — PDF — https://www.eib.org/en/publications/20250028-eib-municipalities-survey-2024-2025

F1 — Financial Times: NYC office-to-housing conversions — paywalled — https://www.ft.com/content/d186596f-d0f6-49c8-ae4c-0f231a961071

N1 — Knight Frank: ESG property investor survey 2025 (PDF) — PDF — https://content.knightfrank.com/research/2740/documents/en/sustainability-series-esg-property-investor-survey-2025-12042.pdf

P1 — European Commission: Energy Performance of Buildings Directive — ~8–12 min — https://energy.ec.europa.eu/topics/energy-efficiency/energy-performance-buildings/energy-performance-buildings-directive_en

Taking a deal to IC? De-risk it before you sign off.

If you’re underwriting a development or repositioning deal, I help investors pressure-test the assumptions that move returns: approvals, capex, programme, ESG, and deliverability—before IC commits.

Free 30-min Discovery Call: we confirm fit, isolate the key risks, and define scope.

If it’s a match, I’ll propose a paid, fixed-scope De-Risk Sprint with clear deliverables.

Book here:

Refer a Colleague

PS…If you’re enjoying this newsletter, please consider referring this edition to a friend or a colleague. Sharing valuable insights helps everyone make better investment decisions.

BENIGNI is a strategic development partner driven by a clear purpose.

We leverage our design and development expertise to create outstanding urban environments that unlock long-term real estate value for investors.

To learn more: click here to visit our website.

Subscribe to the Newsletter

A newsletter by Carlo Benigni providing, in less than 4 minutes, exclusive advice, strategies, and resources to help unlock hidden real estate value.

Subscribe for free to receive new posts and support my work.