Italian Real Estate: Unveiling Trends and Opportunities in 2024

From Milan's Dominance to Emerging Sectors: A Comprehensive Market Overview

Dear Readers,

Following a week of being unwell here is a delayed week 21 issue. This one is a bit different from previous ones and I hope you will find it of value.

Finally a huge welcome to all the new subscribers that have recently joined the Letter.

I hope you will find it valuable.

Please consider upgrading to a Paid Subscription if you would like to show your support to my writing.

Best,

Carlo

Today's newsletter offers a unique perspective on the Italian Real Estate Market, focusing on current trends and emerging sectors based on observations from the past couple of years.

Having relocated to Milan after two decades in London, UK, I've gained valuable insights into the Italian market's trends, challenges, and opportunities.

The Italian Real Estate market is characterised by:

Fragmentation

Partial opacity in certain aspects

This market's slow digital transformation has resulted in limited public information. Consequently, on-the-ground connections and personal conversations remain crucial for gathering insights.

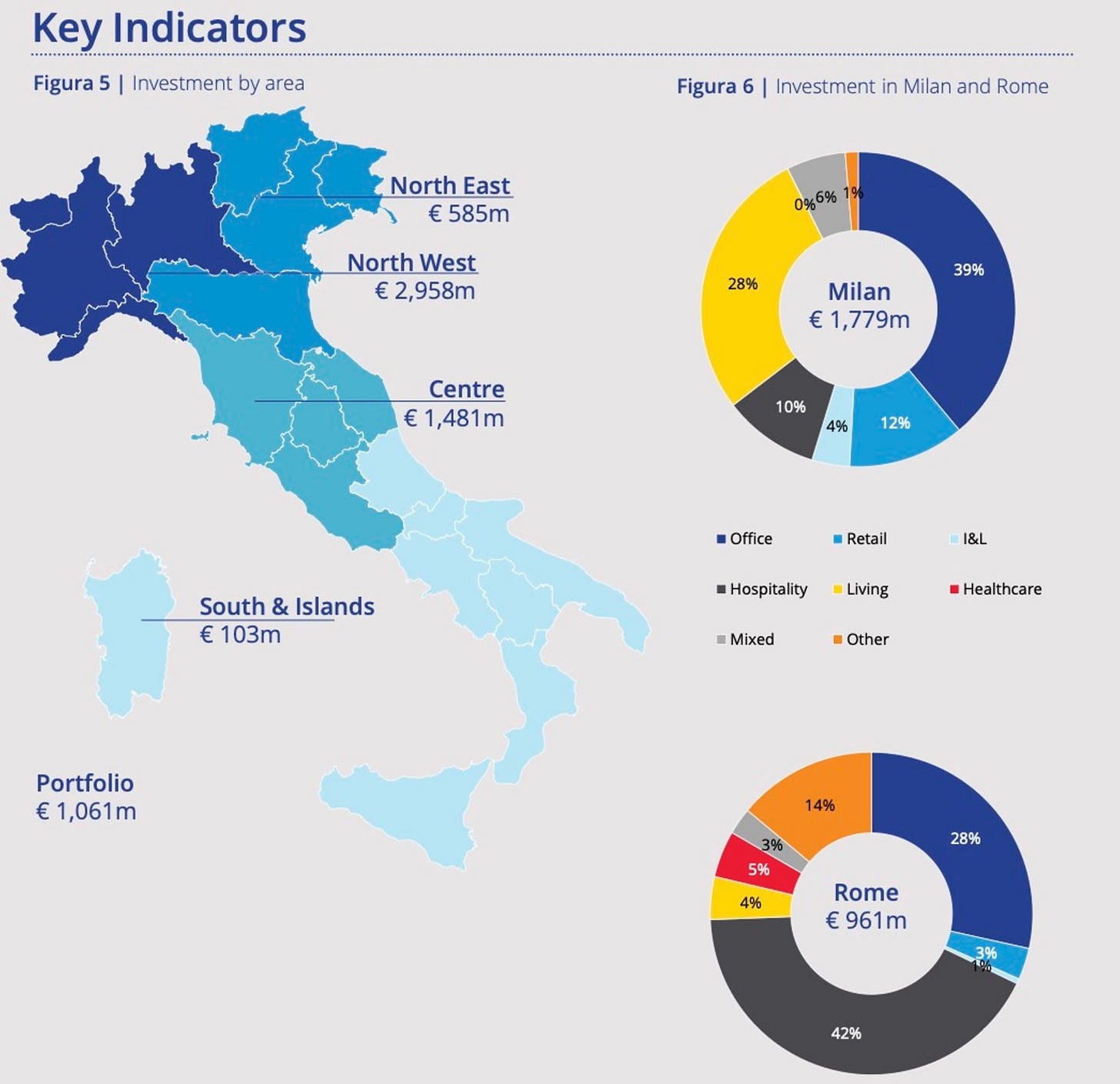

Milan has long been the epicenter of Italy's real estate market, attracting the largest investment volumes. However, Rome is gaining attention, partly due to the upcoming 2025 Christian Jubilee, which is catalysing significant infrastructure upgrades across the city.

This newsletter explores the following trending sectors in Italy's real estate market:

Hospitality.

Student Living (PBSA).

Residential Living.

Data Centres.

Challenges and Opportunities.

Let's dive in.

1. Hospitality

The Italian hotel sector, severely affected by the COVID-19 pandemic, saw demand and occupancy return to pre-pandemic levels in late 2023.

Investment in the sector surged, with volumes reaching €1.5 billion in 2023, a 1% increase from 2022. Italy outperformed other European markets, driven by a 46% increase in Average Daily Rate (ADR) and substantial Revenue Per Available Room (RevPAR) growth, particularly in Rome (+55% compared to 2019).

“RevPAR of largest listed hospitality players now above pre covid levels” - Rotschild & Co

Over 55 new hotels are expected to open in 2024, with Rome and Milan seeing less than 2% supply growth, highlighting a stable future for the sector.

2. The Rise of Purpose-Built Student Accommodation (PBSA)

The PBSA sector in Italy is attracting significant interest due to growing potential and increasing demand from domestic and international students. As a developing sector compared to more mature European markets, it presents substantial growth and investment opportunities.

Italy's student accommodation provision rate stands at 3.8%, considerably lower than in mature European markets, signalling significant growth potential.

Prime rents for student accommodation are highest in Milan (€1,420/month) and Florence (€1,350/month), followed closely by Rome (€1,300/month).

By 2027, it is projected that an additional 23,600 beds will be completed in major Italian cities, with Milan and Turin seeing the highest completion rates.

Notable investments include:

Aparto Giovenale, Milan: Sold by Hines to an Italian pension fund for over €100 million. The project involved the complete refurbishment of an obsolete property, now providing over 600 high-quality beds .

Turin PBSA Scheme: Patrizia AG invested €70 million in a new-build PBSA scheme located in Via Frejus, close to Politecnico di Torino and the University of Turin. This project was completed and inaugurated in 2023.

3. The Dynamic Residential Sector

Italy's living sector, encompassing the residential real estate market, remains a vibrant and crucial component of the country's real estate landscape. Its robustness is driven by urbanisation, a growing middle class, and legislative changes addressing housing shortages.

Private Rented Sector:

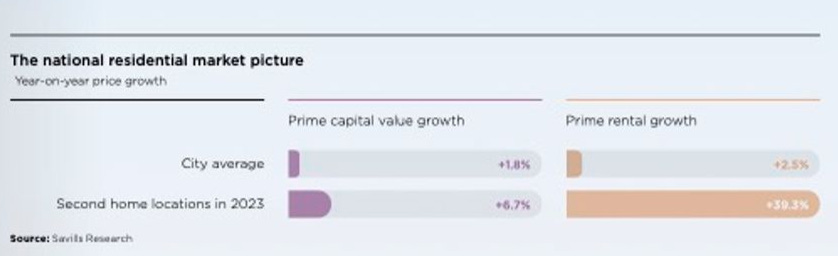

The rental market has experienced substantial growth, driven by strong demand and limited supply. Prime rents increased by 2.2% in 2023 and 7.0% compared to 2019.

Milan's prime residential prices remain high. Despite a 15.2% decrease in transaction volumes in 2023, prices have remained stable due to low supply.

To address limited housing stock, new legislation is being proposed to restrict short-term tourist rentals, particularly in historic city centers.

Milan is projected to experience positive rental growth in 2024, with forecasted price growth of up to 1.9%, driven by a robust rental market and potential interest rate reductions.

4. The Booming Data Centre Sector

Italy's data centre sector is undergoing rapid growth and transformation, fuelled by increasing demand for data processing and storage capabilities. The country's central European location positions it as an ideal gateway for data traffic between Europe, the Middle East, and Africa, enabling low-latency connections and efficient data flow across regions.

While Milan remains the primary focus, there's growing interest in developing data centres in other regions to distribute demand and alleviate pressure on major cities. This trend is supported by the emergence of EDGE Data Centres – smaller facilities designed to be closer to end-users, reducing latency.

5. Challenges and Opportunities

Addressing the challenges and capitalising on the opportunities across various sectors in Italy's real estate market is crucial for ensuring sustainable growth and resilience.

Challenges:

Energy Consumption: The high energy demands of data centres and the need for sustainable practices in all sectors necessitate innovative solutions to reduce environmental impact and operational costs.

Regulatory Complexity: Navigating Italy's intricate regulatory environment, with its regional variations, can be daunting for developers and investors across all real estate sectors.

Land Scarcity: Finding suitable land, particularly in prime areas like Milan, remains a significant challenge due to limited availability and high costs, affecting development in hospitality, PBSA, residential, and data centres.

Opportunities:

Technological Advancements: Innovations in sustainable building technologies and energy-efficient systems present opportunities for enhancing operational efficiency and reducing costs.

Urban Regeneration: Redeveloping brownfield sites can address land scarcity, revitalize urban areas, and provide new development opportunities.

Growing Demand: The increasing demand for student accommodation, luxury hotels, and residential properties offers substantial growth potential, attracting both domestic and international investors to Italy's real estate market.

Key Takeaways

Significant Growth: Italy's real estate market is poised for substantial growth across multiple sectors.

Hospitality: Increased investment and new hotel openings signal robust recovery and future potential.

PBSA: Growing international student numbers and current undersupply offer significant opportunities.

Living Sector: Urbanization and demographic changes fuel growth in the private rented sector, despite high prices and limited supply.

Data Centres: Swift expansion backed by technological progress and the digital economy.

Challenges: Tackling energy consumption, regulatory complexities, and land scarcity is essential.

Opportunities: Capitalizing on technological innovation, urban regeneration, and regional expansion.

Strategic Investments: Critical for fostering sustainable growth and establishing Italy as a global real estate leader.

Positive Outlook: Securing a promising future for 2024 and beyond through innovative solutions and strategic development.

That's all for today.

See you next week.

Book a Free Discovery Call

To find out more about how I can help you enhance your development project you can book a free discovery call with me by clicking the button below.

Subscribe to the Newsletter

A newsletter by Carlo Benigni providing, in less than 4 minutes, exclusive advice, strategies, and resources to help unlock hidden real estate value.

Subscribe for free to receive new posts and support my work.